What is a foundation?

A foundation is “an entity that supports charitable activities by making grants to unrelated organizations or institutions or to individuals for scientific, educational, cultural, religious or other charitable purposes. While foundations are often primarily engaged in grantmaking activities, some may engage in their own direct charitable activities or programs.”

What are the different types of foundations?

Foundations are broadly categorized as either private foundations or public foundations.

Private Foundations

Private foundations are generally financially supported by one or a small handful of sources—an individual, a family or a corporation — and programs are managed by their own board of trustees or directors. Most private foundations must pay out at least 5% of their assets each year in the form of grants and operating charitable activities; a private operating foundation instead must carry out its own charitable purposes. Private foundations include corporate foundations, family foundations and independent foundations. All private foundations are 501(c)(3) organizations.

Public Foundations

Public charities include a wide variety of charitable organizations; charities that primarily make grants are commonly referred to as public foundations. Most of these foundations are publicly supported charities, meaning they receive their funds from multiple sources, which may include private foundations, individuals, government agencies and fees they charge for charitable services they provide. And, they must continue to seek money from diverse sources in order to retain status as a public charity. Public foundations include community foundations, public charities and community college foundations. These public foundations are 501(c)(3) organizations.

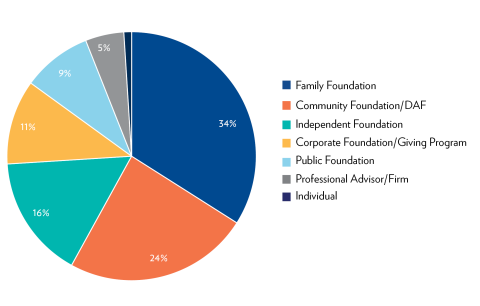

What are the different types of foundations represented in CMF’s membership?

We are a community of philanthropy ─ united, diverse and working together for a better, more equitable Michigan.

You can read about the differences among these members types on the Join page of our website. Any organization or individual fulfilling the criteria pertinent to its type, or category, is eligible to apply for CMF membership.

How many grants are given annually to nonprofits in Michigan?

CMF leads, strengthens and supports our state’s diverse philanthropic community that collectively grants more than $2.1 billion annually to nonprofits. The top funded areas* in our members’ Michigan-based grantmaking include: Education, Human Services, Health, Philanthropy, and Community; Economic Development.

Source: IRS 990 Database and Foundation Directory Online. *This does not include out-of-state or corporate giving program members

Where can I learn more about the economic benefits of Michigan’s foundations and the Michigan nonprofit sector at large?

Public Sector Consultants (PSC) conducted an analysis of the economic benefits of Michigan’s nonprofit sector in 1999 and has published updated figures four times over the last 20 years. The figures below were published in 2018-2019 (View Report), using data gathered between 2015 and 2018.

- The number of nonprofit entities rose to a record high of more than 50,000 after nearly a decade of decline. Nearly all of this growth has been driven by charitable nonprofit 501(c)3s, which now number just over 39,000 in Michigan.

- Nonprofits employed nearly 470,000 people in the third quarter of 2018. This number represents just over one in ten of Michigan’s total nonfarm jobs and is larger than Michigan’s leisure and hospitality industry.1

- In 2018, Michigan’s nonprofits held more than $268 billion in assets, an increase of approximately 13 percent from $234 billion in 2013 (adjusted for inflation). The assets of charitable nonprofits specifically make up 44 percent of these assets.

- Revenues rose more than 17 percent, from $75 billion (2013) to more than $87 billion (2018), adjusted for inflation.

1: Michigan’s leisure and hospitality industry employed 443,100 people in the third quarter of 2018 according to the Bureau of Labor Statistics.

Nonprofits in Michigan serve a wide range of purposes. The following Exhibit from the 2018-2019 report details Michigan’s nonprofit sector during the last 21 years by IRS classification. According to the IRS, in 2018, Michigan had 50,654 nonprofits. This amount represents a 19.5 percent increase since 2013, but only a 3.1 percent increase in total organizations since 2009 (the previous high).

The vast majority of Michigan’s nonprofits are charitable and religious organizations, and these categories of nonprofits have grown in both size and share of total nonprofit organizations since this data was collected.

Michigan Nonprofits by Tax Status is available in the Economic Benefits of the Nonprofit Sector, Public Sector Consultants, 2018

How can I learn more about foundations in Michigan and across the country?

How can I make a financial contribution to my community through philanthropy?

Individuals, families and companies regularly reach out to CMF to learn how they can give back to their communities through philanthropy. CMF has compiled two reports "Options for Your Financial Giving," a resource for individuals and families, and "Choosing a Corporate Approach," a resource for companies.

Where can I learn more about the beginnings of CMF and leadership of Michigan philanthropy through the decades?

As part of the Council of Michigan Foundations' (CMF) 50th anniversary celebration, we are honoring our past and looking to the future with a bold vision grounded in our shared commitment to putting equity at the center. With the leadership of the CMF 50th Anniversary Committee, we are pleased to share this virtual timeline featuring highlights of our community of philanthropy’s storied history, from CMF’s earliest beginnings to the present day. We invite you to explore the timeline and learn about the people, practices and policies that have shaped where we are now and how we will continue to lead, strengthen and support Michigan philanthropy in the decades to come.

Where can I learn more about the U.S. history of philanthropy?

The History of U.S. Philanthropy Timeline features stories of diverse individuals and organizations who have used their time, voice, connections and resources to make an impact in the world. Young people, who are capable changemakers, can examine this history to question and explore the ways philanthropy has created lasting change and changed itself. By sharing stories of the past, we equip and empower youth to shape the story of philanthropy today and in the future. Youth voice and action are part of this story.

Visit the timeline here.

This project was developed in collaboration with Indiana University Lilly Family School of Philanthropy and Learning to Give, a program of the Council of Michigan Foundations.